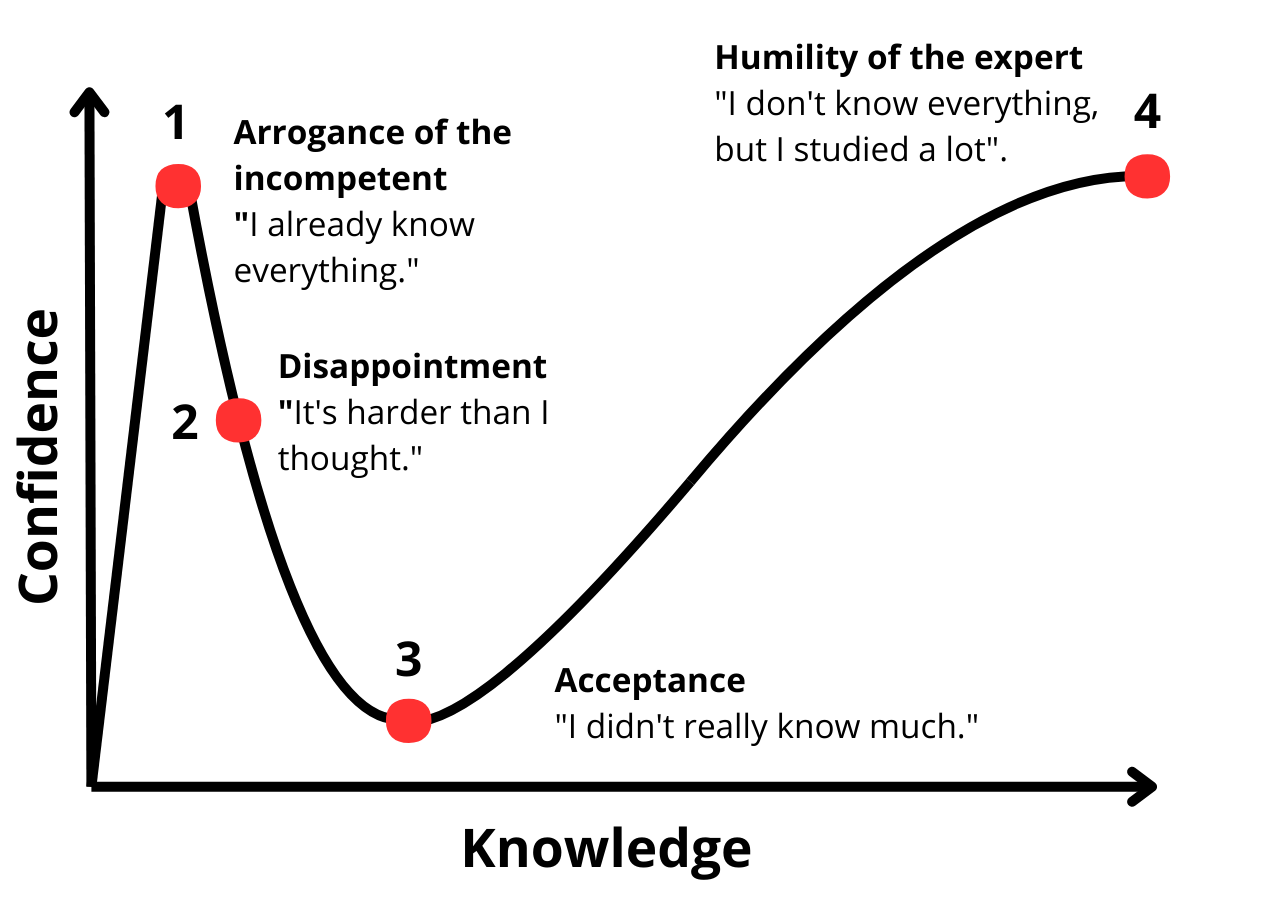

I Came From Fintech Thinking Sports Betting Would Be Easy! ...lol

I just experienced 2 and 3 rapidly today, after listening to my first episode of The Early Edge:

When I first started building PriceArb, I thought applying my fintech background to sports betting and prediction markets would be straightforward.

I've spent years building fintech products. Options pricing, market microstructure, order flow analysis—that was my world. When I started getting interested in event contracts and event markets, I started building PriceArb, thinking that applying my quantitative methods from the stock, options, and futures markets to prediction markets and sports betting would be straightforward - even easy! 😅

hehe woops...

"Uh... What's a 'Sharp'?"

Through my recent sports betting deep dives and research with PriceArb, I (again, humbly began to realized) the sports betting world has developed an ENTIRE vocabulary of its own - decades of slang, metrics, and concepts that map surprisingly well to institutional finance. But if you don't know the language, you're immediately exposed as an outsider.

Luckily, I've collected (so far) a comprehensive list of terms I've learned.

The Ultimate Basics: "Square" Talk

Let's start with what the recreational bettors say.

In the 'professional' sports betting world, a Square is the retail bettor—gut-feel picks, favorite team loyalty, losing to the vig (read on below - I also had no idea what this was) over time. In finance terms: dumb money. The person buying weekly out-of-the-money options because they "feel good about earnings."

The Vig (or Juice) is the house edge. If both sides of a bet are −110, the sportsbook takes a 4.54% cut on every dollar. It's the spread. The commission. The reason most bettors lose long-term.

Chalk means the heavy favorite. "Betting the chalk" is like buying FAANG stocks because they're obvious winners. Safe, boring, and usually not where the edge is.

A Parlay is a multi-leg bet where all selections must hit. Think of it as a structured product with massive leverage but terrible expected value. The sportsbook loves when you parlay. The math is brutal.

And a Bad Beat? That's when you lose on a statistical anomaly in the final seconds. A garbage-time touchdown that doesn't change the winner but ruins your spread. The options equivalent: getting assigned on a short put after-hours on a random news headline.

Actual Trading Terms

This is where it gets more interesting.

Handle is total volume—the notional amount of bets taken. When you hear "the Super Bowl handle was $180 million," that's the gross traded amount.

Hold is gross margin. It's what the sportsbook keeps after paying winners. Handle is revenue. Hold is what matters for the book's P&L.

The Hook is the 0.5 in a spread (like −3.5). It exists to prevent a push (a tie where money returns). It forces a binary outcome. No ambiguity. One side wins, one side loses.

Middling is a classic arb play. You bet Team A at +7.5 early in the week. The line moves. You bet Team B at −3.5. If Team B wins by 4, 5, 6, or 7? You win both sides. It's rare but it's pure arbitrage when it hits.

And here's one that's directly relevant to what we're building: a Stale Line is a price that hasn't updated yet. If a podcast drops injury intel at 6am and the book doesn't move until 9am, that three-hour window is a stale line. Free money for anyone paying attention. This is similar edge the inefficiency PriceArb tries to surface with our live edges dashboard.

Sharp-Level Concepts

Now we're getting to the professional tier. This is where I realized sports betting isn't just gambling—it's a quantitative discipline with decades of developed methodology.

CLV (Closing Line Value) is the gold standard metric for professional bettors. It measures the difference between the price you got and the final price when the game starts.

Here's the key insight: even if you lose the bet, if you beat the closing line, you made a sharp trade. You bet at −3 and it closes at −5? That's +2 points of CLV. Over thousands of bets, positive CLV correlates directly to profitability. It's the sports betting equivalent of measuring alpha against a benchmark rather than just looking at returns.

Steam is a sudden, rapid move across the entire market. Usually means a syndicate—a coordinated group of professional bettors—just unloaded a large position. When steam hits, the whole market reprices within minutes.

Reverse Line Movement (RLM) is when the public money is going one way but the line moves the opposite direction. If 80% of bets are on Team A but the line moves toward Team B, that's a massive signal. The book is reacting to sharp money, not square volume. The 20% is smarter than the 80%.

A Beard is a proxy bettor. Sportsbooks limit and ban winning players (yes, really—they just kick you out if you're too good). So sharps use beards: people with clean accounts who place bets on their behalf. It's like using multiple brokers to avoid pattern detection. Legal but ethically gray.

The Originator is the alpha source. This is the person who actually builds the models and determines what a line should be. Everyone else is just "tailing"—copying their positions. In finance terms: the originator is running the quant fund. The tailers are reading Seeking Alpha.

And finally, sizing slang: a Nickel is $500. A Dime is $1,000. "I put five dimes on the over" means $5,000 on a single position. The lingo exists because talking about specific dollar amounts in public spaces attracts attention.

Building for This World

PriceArb started as a simple hypothesis: prediction markets misprice events because crowds are emotional. History provides a baseline. The gap is the edge.

What I've learned is that this space already has decades of sophisticated thinking behind it. The sharps know things. The books know things. The data exists. The challenge is making it accessible to people who think quantitatively but didn't grow up in this world.

We're building tools for that. Free calculators for position sizing and multi-outcome strategies. Dashboards that surface probability edges in real-time.

If you're coming from finance or tech and you're curious about prediction markets—welcome- trust me when I say we're on this journey together. It's humbling but it's learnable. And the inefficiencies are real.

Just don't walk in thinking it'll be easy :)

-Chris

All trading involves risk. This is a research tool, not financial advice.